ACH processing speed

ACH payments are processed in batches and must be uploaded to Moov’s partner financial institutions before certain cutoff times. In general, no news is good news - the payment succeeded unless you receive a subsequent return file stating that it did not.

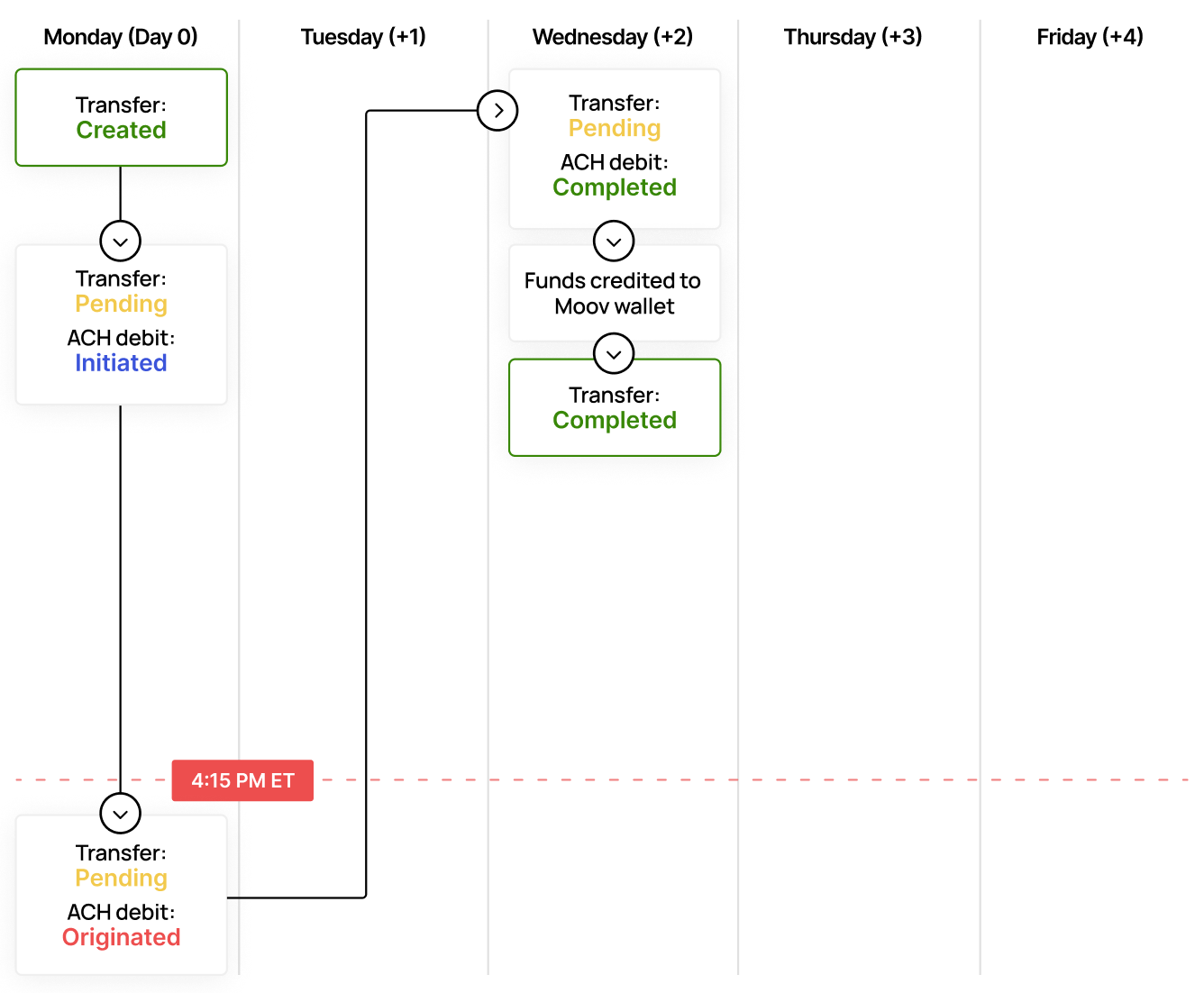

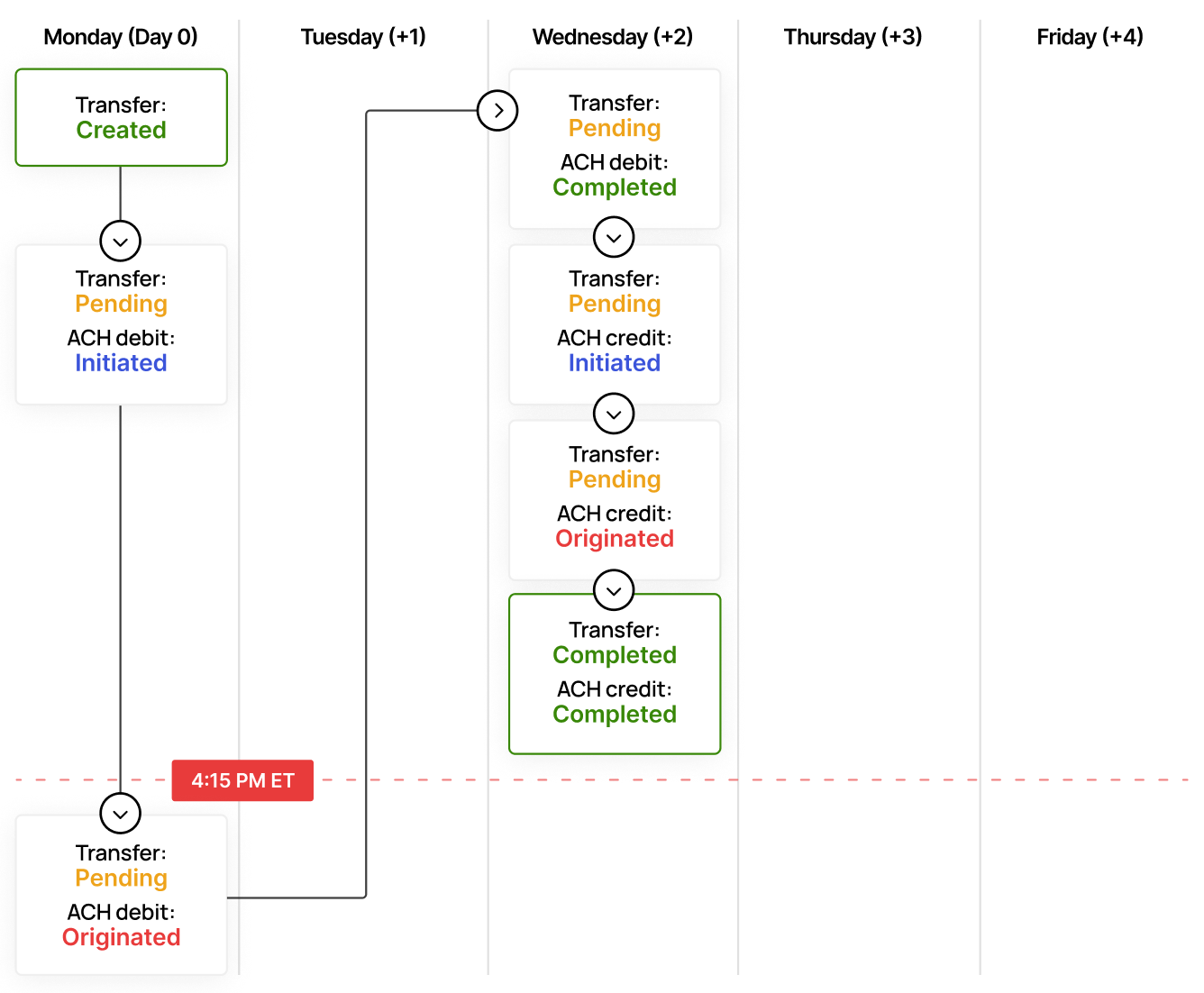

With standard ACH processing, Moov holds funds that enter the platform via an ACH debit for two banking days before making the funds available. The purpose of the hold is to account for the lag in time it takes to hear back about returns or processing issues. In most circumstances, funds are made available in the morning of the second banking day after the transfer was created for example, Wednesday for a Monday transfer. See the full timetable below.

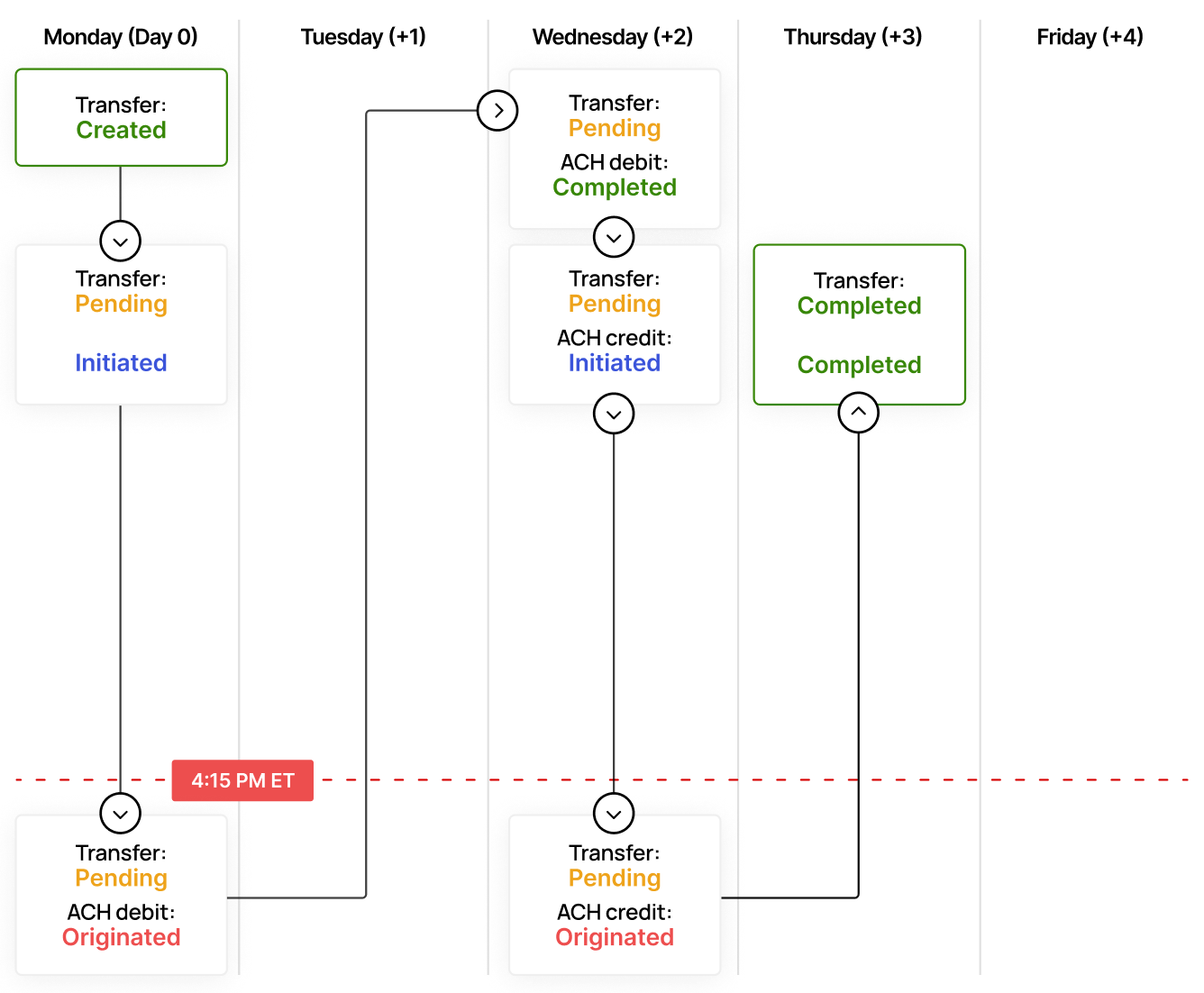

With faster ACH processing, you can bypass the two day hold period. With no debit hold period, the credit process starts within hours after the transfer is created. Both bank-to-wallet and bank-to-bank transfers will complete within one day as long as the transfer is created before the specified cutoff times. See the full timetable below.

If the transfer is created after a cutoff time, it will be processed according to the same schedule on the next banking day. Banking days refer to M-F, excluding the Federal Reserve’s bank holidays. See the transfers overview guide for more information.

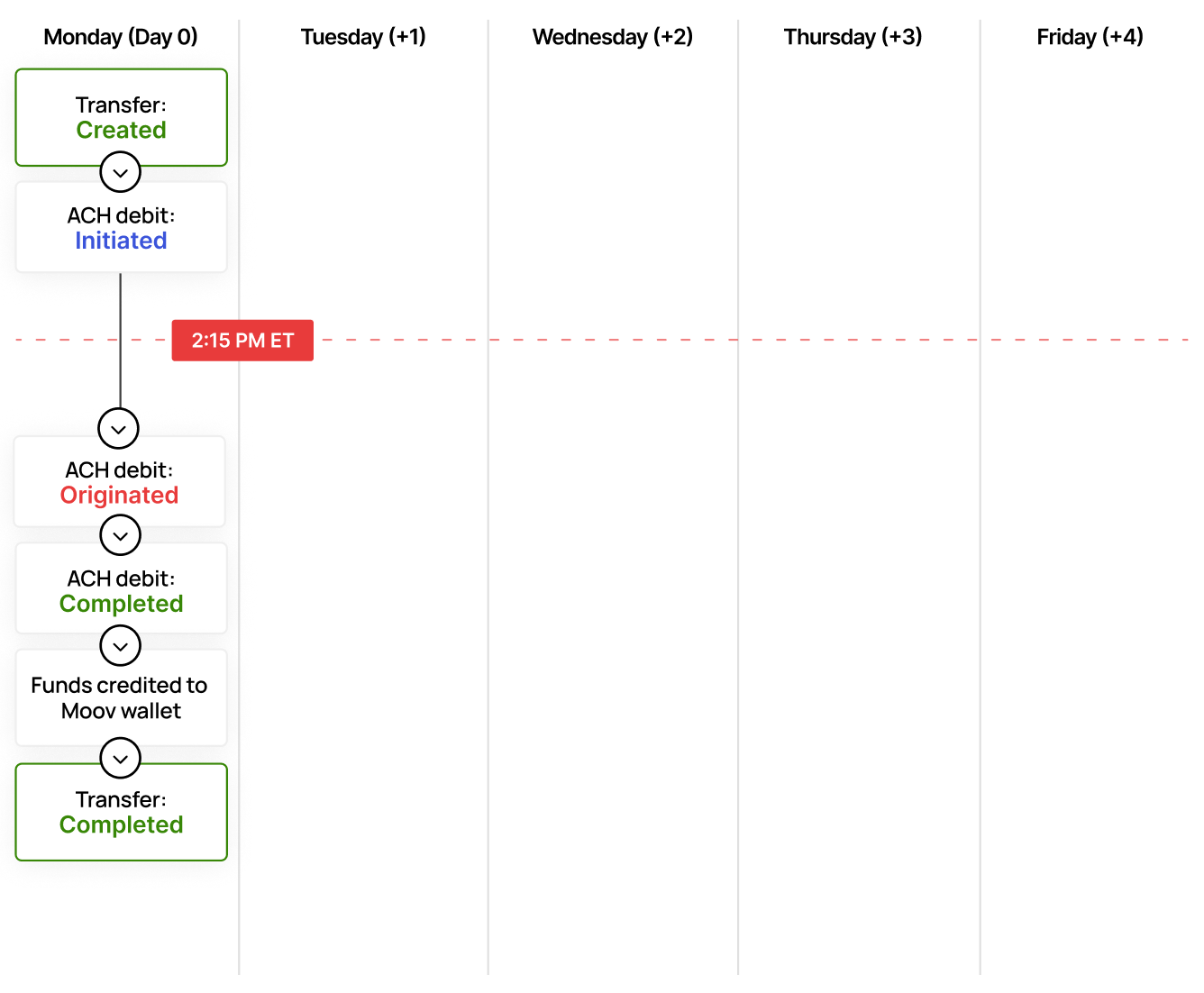

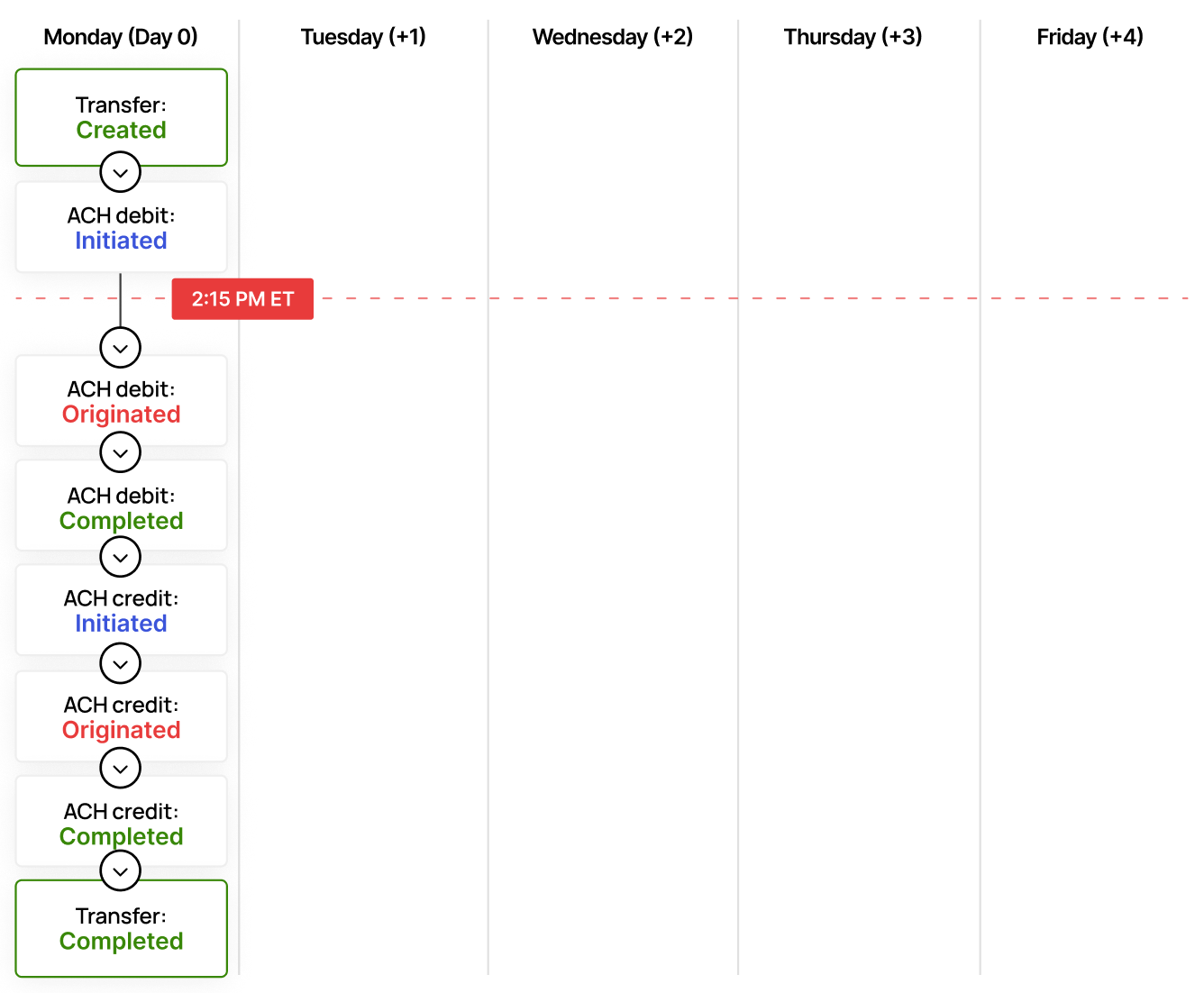

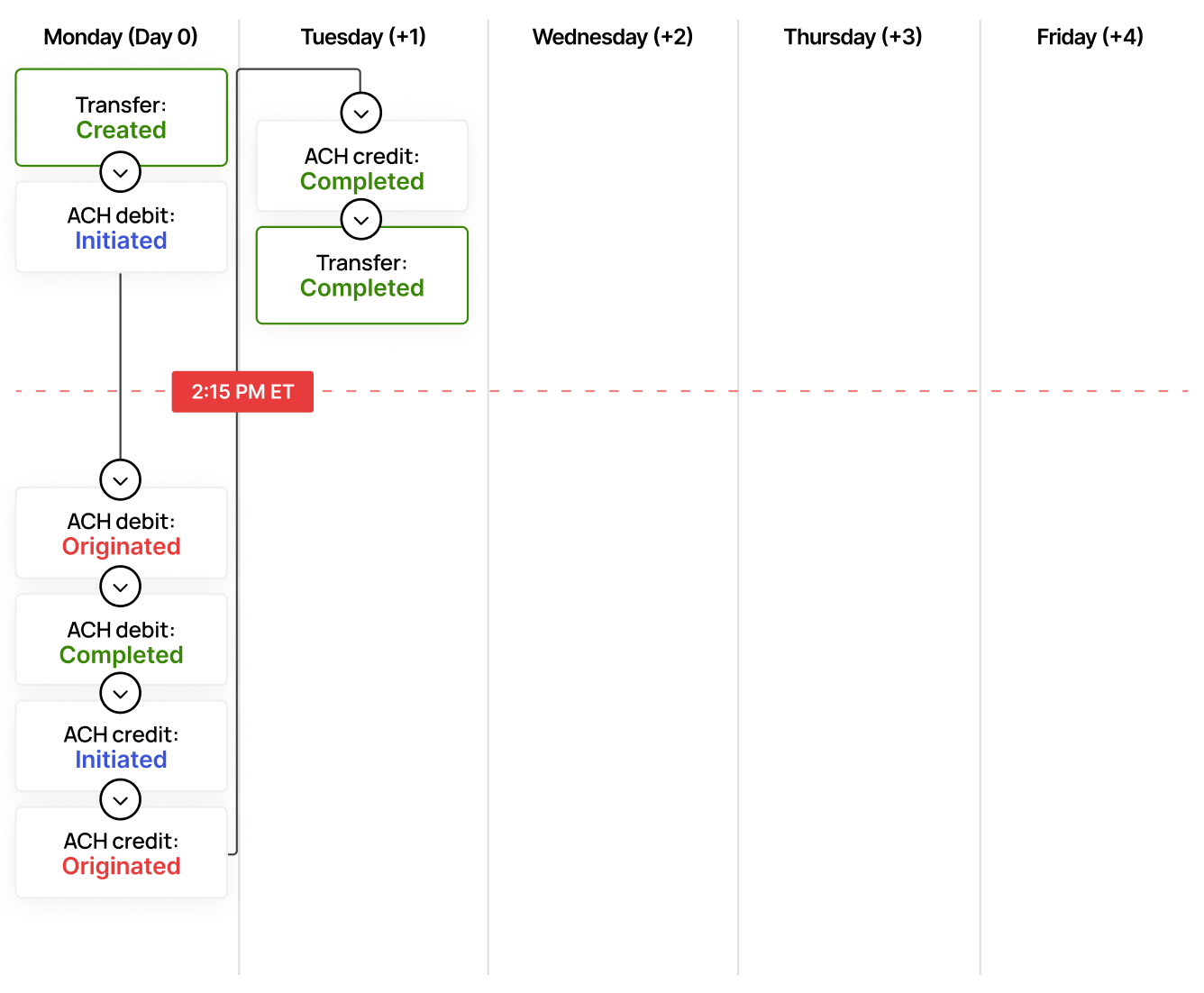

Standard same-day processing

To expedite standard processing, Moov processes all ACH debits with same-day processing when available. You can request ACH credits to be processed same-day by using an ach-credit-same-day payment method as the transfer destination.

The diagrams below show various standard processing timelines based on the 4:15 PM ET cutoff window.

Faster same-day processing

When an account is approved for faster processing, Moov will set the debit hold period to no-hold as a default for all relevant transfers. The debit portion of the process will complete within a few hours of originating.

Bank-to-wallet transfers will complete within one day as long as the transfer is created before 4:15 PM ET.

Bank-to-bank transfers will complete within one day as long as the transfer is created before 2:15 PM ET.

If a bank-to-bank transfer using ach-credit-same-day is not created before the same-day cutoff time, it will complete based on the cutoff times below:

| Created by | Debit completes |

|---|---|

| 10:00 AM ET | ~ 1:00 PM ET |

| 2:15 PM ET | ~ 4:00 PM ET |

| 4:15 PM ET | ~ 6:00 PM ET |

| 5:30 PM ET | ~ 7:00 AM ET (+1) |

Faster processing is for those who are comfortable with debits clearing quickly from an account. In cases of returns (for example, insufficient funds or accounts closed), funds will be debited from the wallet according to Moov’s ACH returns and exception handling process.

no-hold by default, you can overwrite this in the achDetails of the create a transfer POST request by passing in 2-days to debitHoldPeriod.

The diagrams below show various faster processing timelines based on the 2:15 PM ET cutoff window.