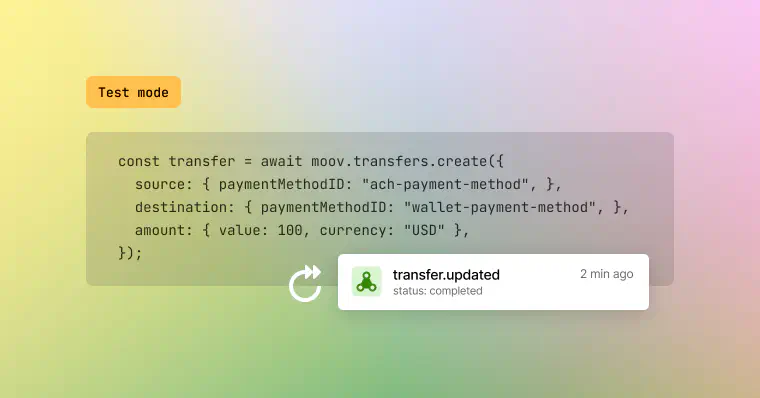

ACH transfer timing in test mode

ACH transfer timing in test mode

Previously, ACH transfers in test mode followed the same processing windows as production mode, taking up to 48 hours to process. However, we’ve updated our platform so that ACH transfers in test mode now complete much faster (within about an hour), since no real money movement is happening.

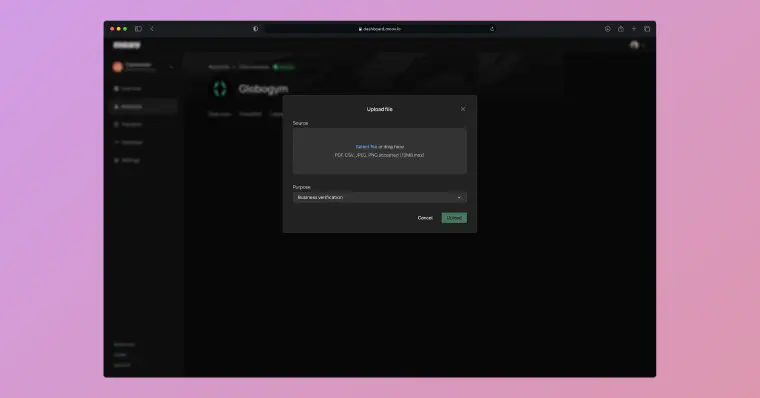

Changelog style

If you haven’t noticed already, our changelog got a new look. We now include titles in addition to the date timeline so you can get a quick sense of Moov’s latest product updates.

Synchronous transfer creation response

We added a 201 response for synchronous transfer creation. If Moov is unable to get transfer details that are returned in the 200 synchronous response, we’ll return a 201 confirming the transfer was created with the transferID.

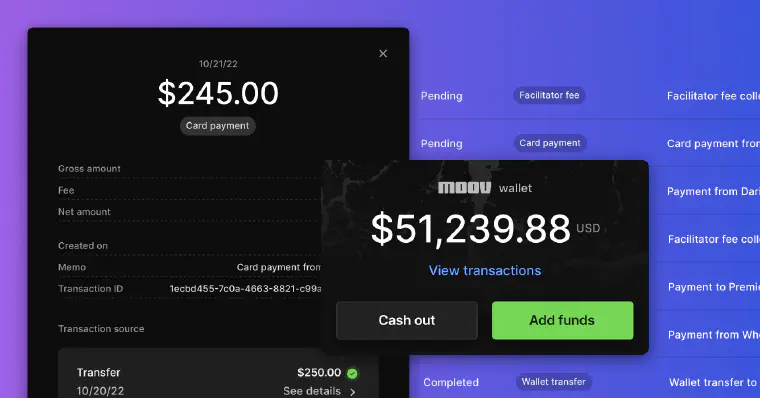

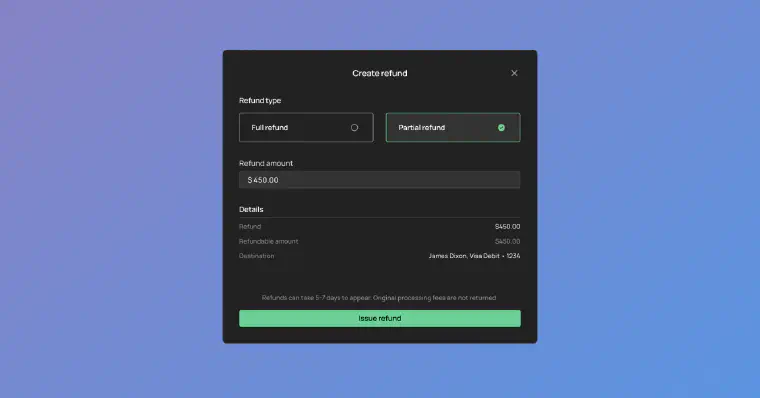

Card acceptance

We reduced the potential for latency during periods of high traffic by adding rate limiting to some of our asynchronous processes.

Bug fixes

We resolved a bug in the Dashboard where the list of members were sorted in reverse alphabetical order by last name. We revised this so the list of members are sorted in alphabetical order.

Styling was broken for the card link iframe within the Payment method Drop. The styling has been updated and now works correctly.