Tap to Pay on iPhone & Android

Tap to Pay on iPhone

With Tap to Pay on iPhone, merchants can seamlessly and securely accept contactless payments using only an iPhone and a supporting iOS app — with no additional hardware needed. Tap to Pay on iPhone accepts all forms of contactless payments, including Apple Pay, contactless credit and debit cards and other digital wallets.

Moov has a new MoovKit Swift SDK for Tap to Pay on iPhone functionality. View our Tap to Pay for iPhone guide for more information.

Tap to Pay on iPhone accept and decline functionality is also available to test in test mode.

Tap to Pay on Android

With Tap to Pay on Android, merchants can seamlessly and securely accept contactless payments using an Android device's built-in NFC capabilities. Customers can tap their contactless card or mobile wallet against the merchant's phone to securely complete transactions.

Moov has a new Android SDK for Tap to Pay on Android functionality. View our Tap to Pay on Android guide for more information.

Tap to Pay on Android accept and decline functionality is also available to test in test mode.

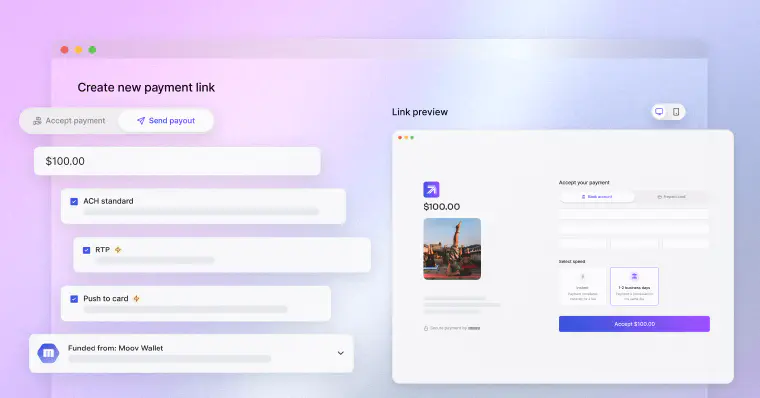

Payment link updates

If set, payment links will now display line items for Apple Pay. Additionally, the initial load time for payments links has decreased.

Bug fixes

- Fixed a missing field issue with the TypeScript SDK

202responses - Fixed an issue with calculating debt repayment interchange rates

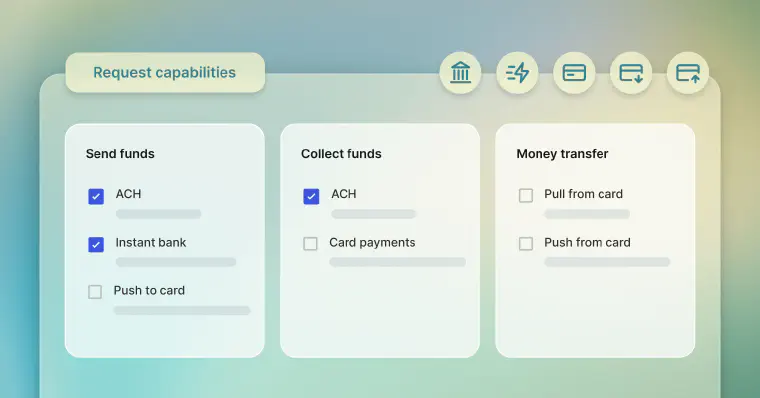

- Fixed a race condition when selecting capabilities for merchants who have previously been disabled