Pull from card & disputes in test mode

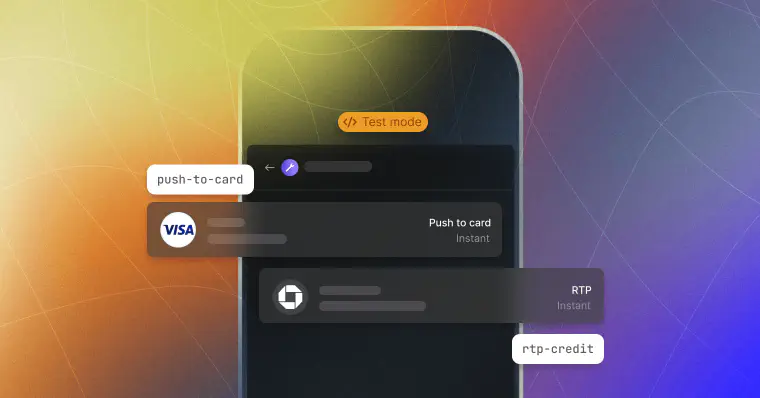

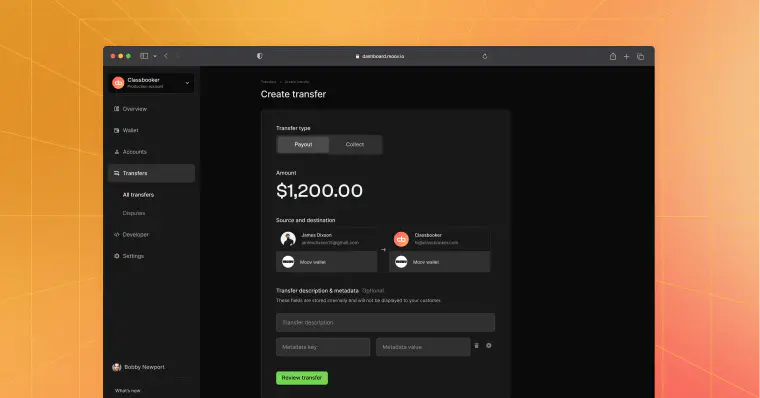

Pull from card available in test mode

You can now use test card numbers for both pull-from-card and push-to-card payment methods. You can use these payment methods in test mode to simulate completed and failed Visa and Mastercard transfers.

To use these payment methods in test mode, you'll need to remove existing test card numbers. This includes 4111111111111111 for transfers and/or 4000020000000000 for declines.

Find more information and instructions in the test mode guide.

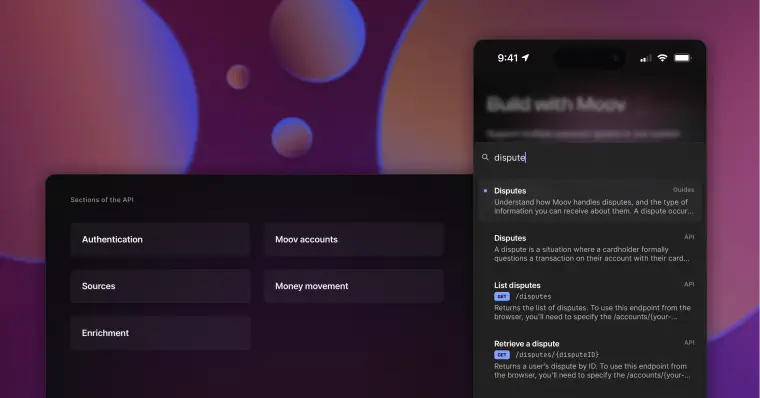

Disputes available in test mode

Test card numbers are also now available to simulate disputes for Visa, Mastercard, Discover, and American Express. You can simulate chargebacks, as well as American Express inquiry disputes.

Find more information and instructions in the test mode guide.

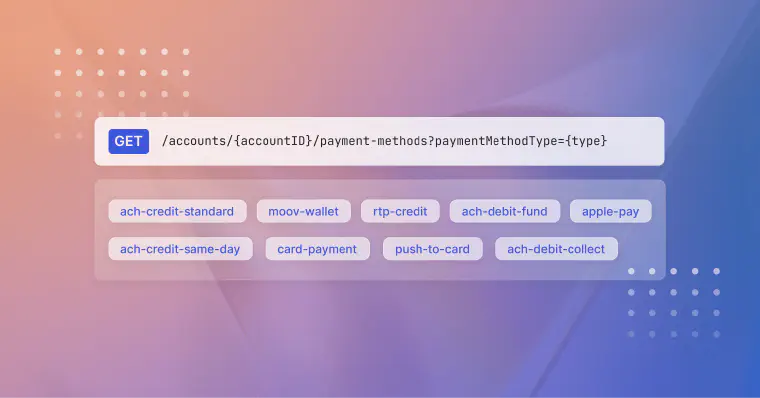

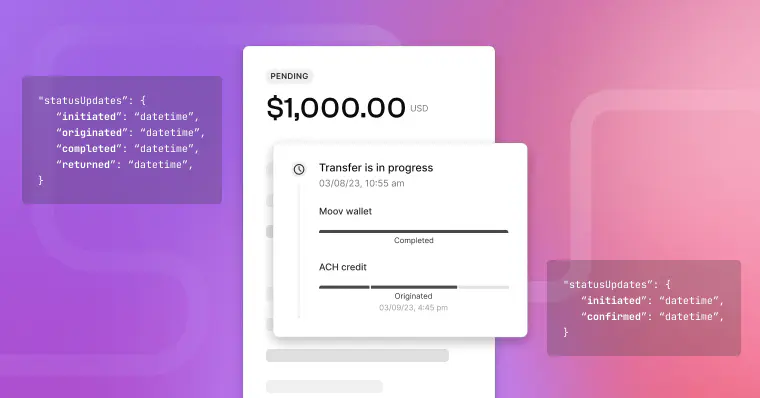

Reminder: API field updates

Last week, we announced new deprecated fields:

- Account

verificationStatus - Underwriting

status

Review your app to determine if you’re still using the deprecated fields.

We also announced a new in-review capability status. The in-review status communicates when Moov is manually reviewing account details to enable a capability — you don't need to take any further action. The existing pending status will notify you if further action is needed, for example, providing any missing capability requirements.

Review your app to determine if the new in-review capability status will negatively impact your system.