Moov Drop enhancements, sweep statement descriptor, & more

Moov Drops

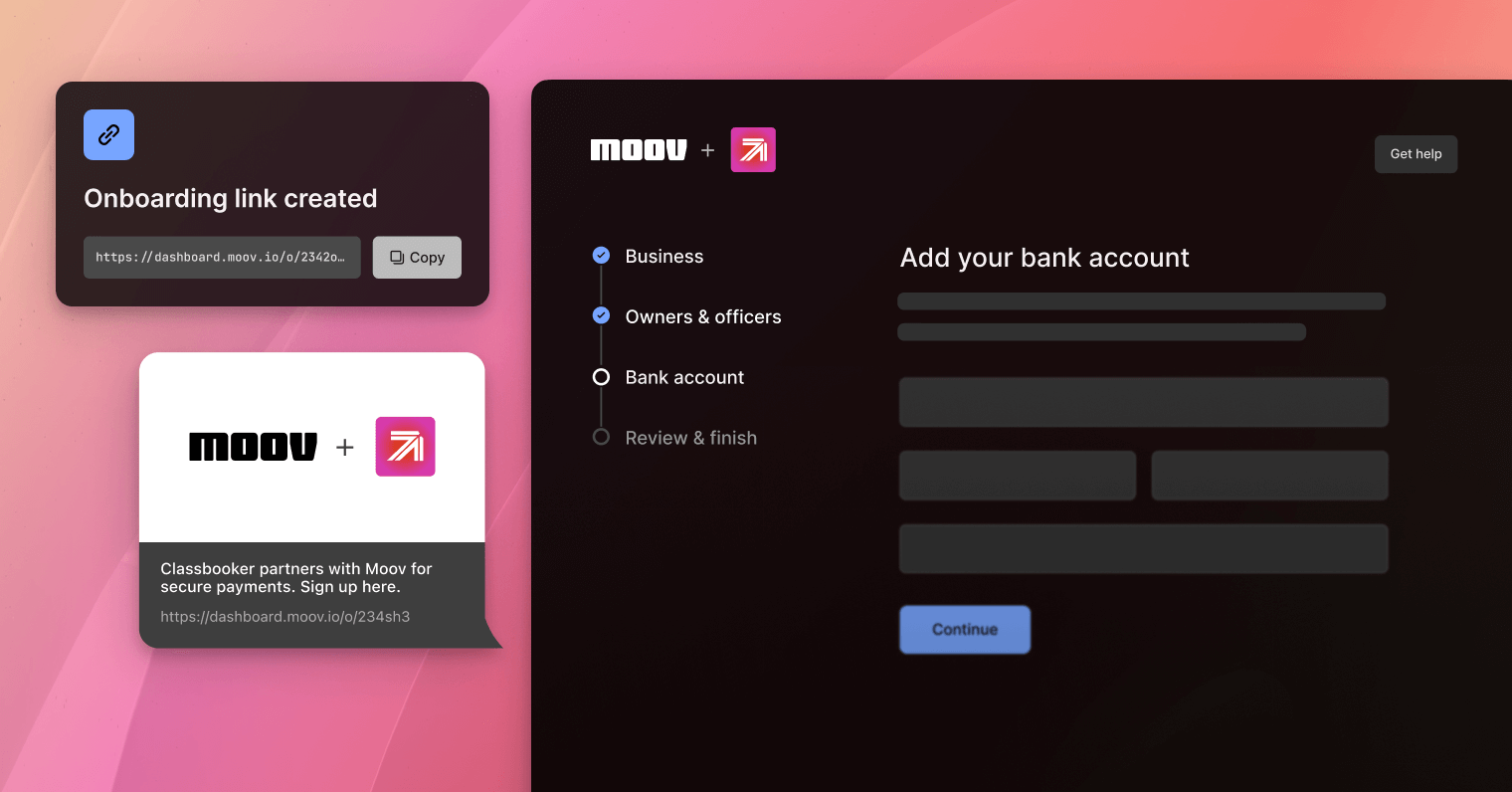

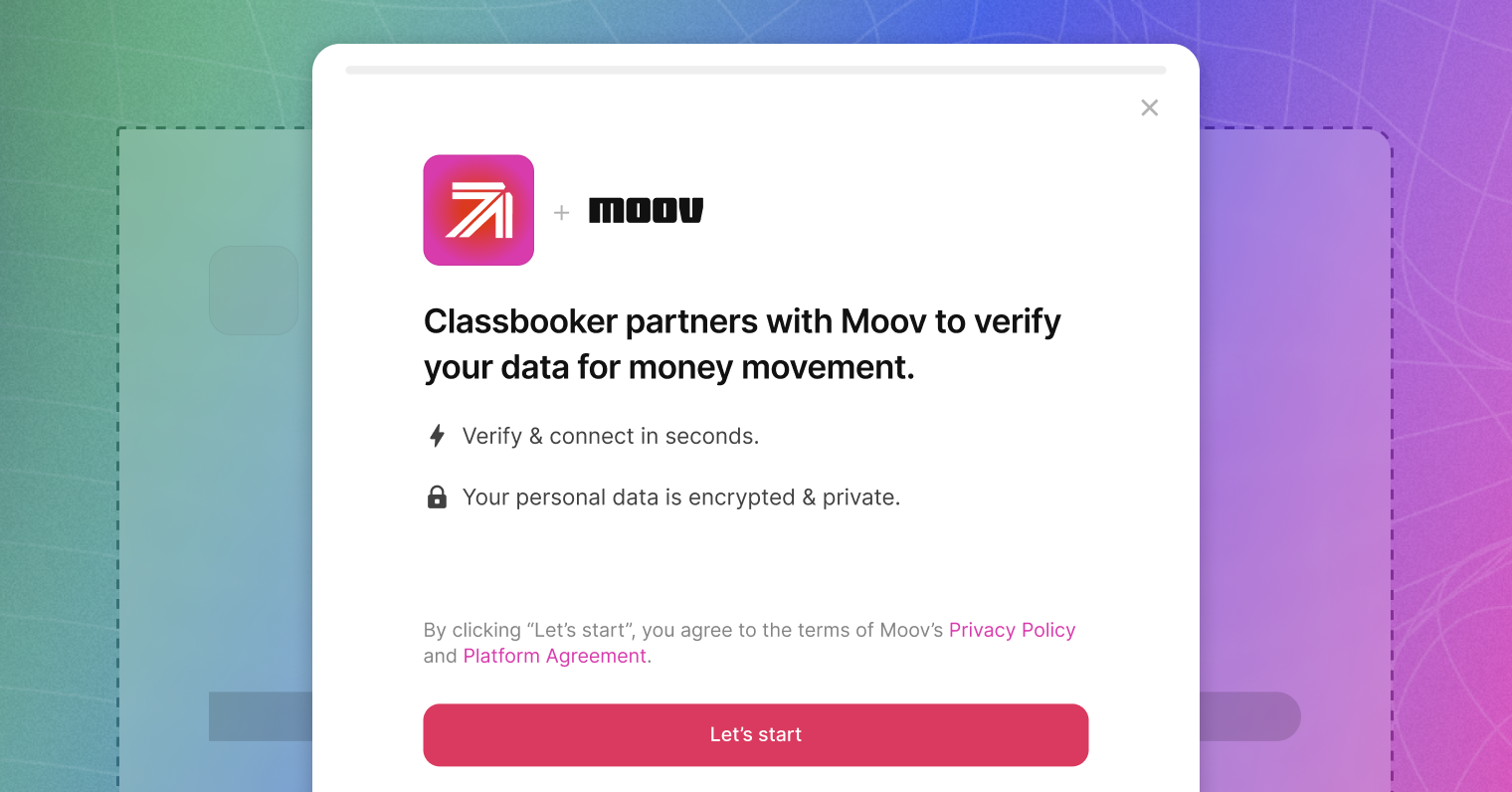

We freshened up the design of the onboarding, payment method, and file upload Moov Drops, improving behavior on small screens and increasing color contrast and legibility.

You can now customize the border radius of elements within the onboarding, payment method, and file upload Moov Drops. Use --moov-radius-large and --moov-radius-small in your theme to change them from the default.

Show your business’ avatar on the start page of the onboarding Drop by adding the showLogo property to the component or setting the show-logo attribute to true.

|

|

- Financial institutions will be asked for their primary regulator from the onboarding Drop.

- Loan linked bank account type can be added from the payment method and onboarding Drops.

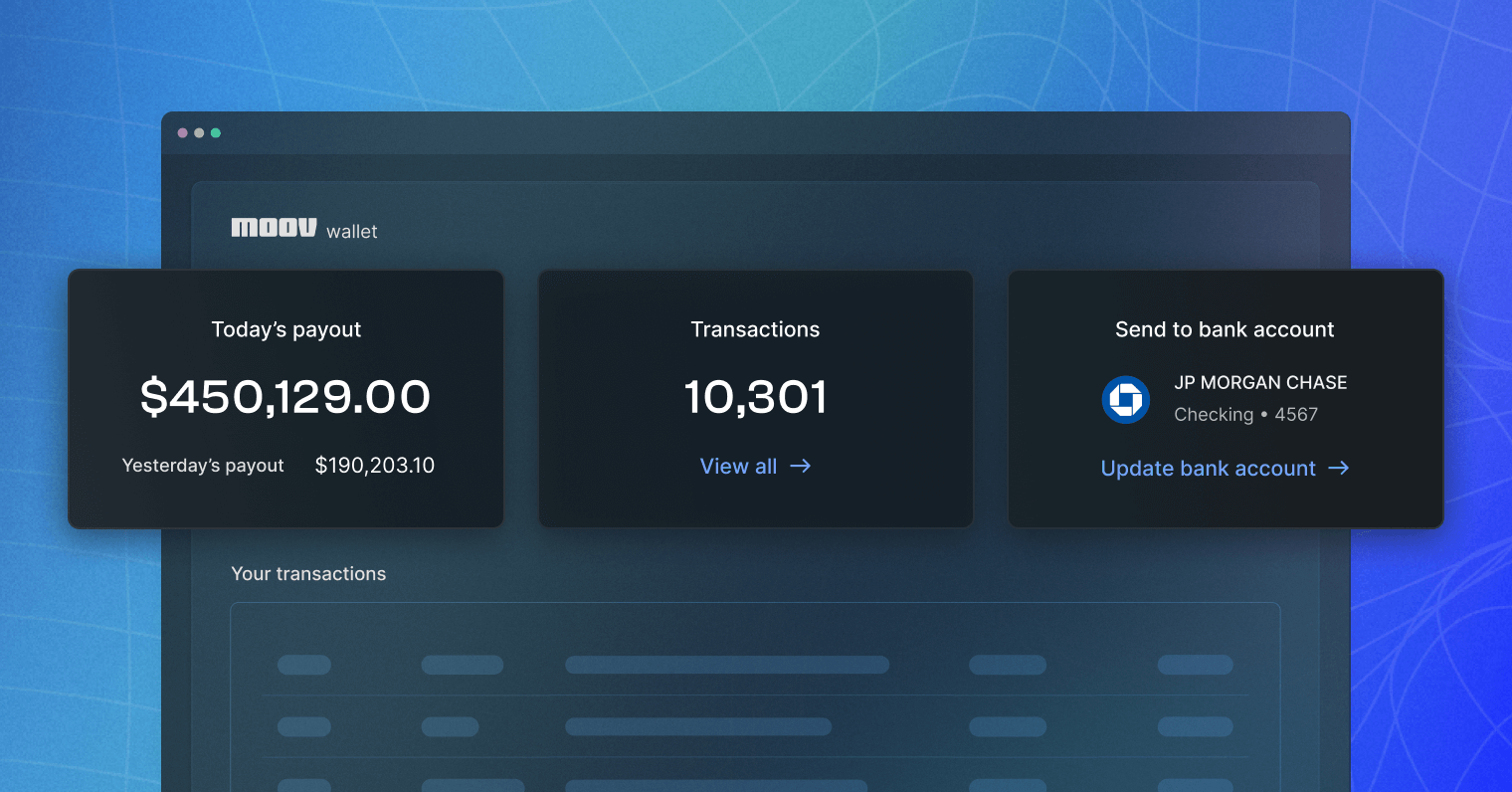

Wallets

Now by default, transfers created by sweeps include a short, unique identifier used in company entry descriptions which appear on the recipient’s bank statement. On each sweep, you can view this descriptor in the statementDescriptor field.

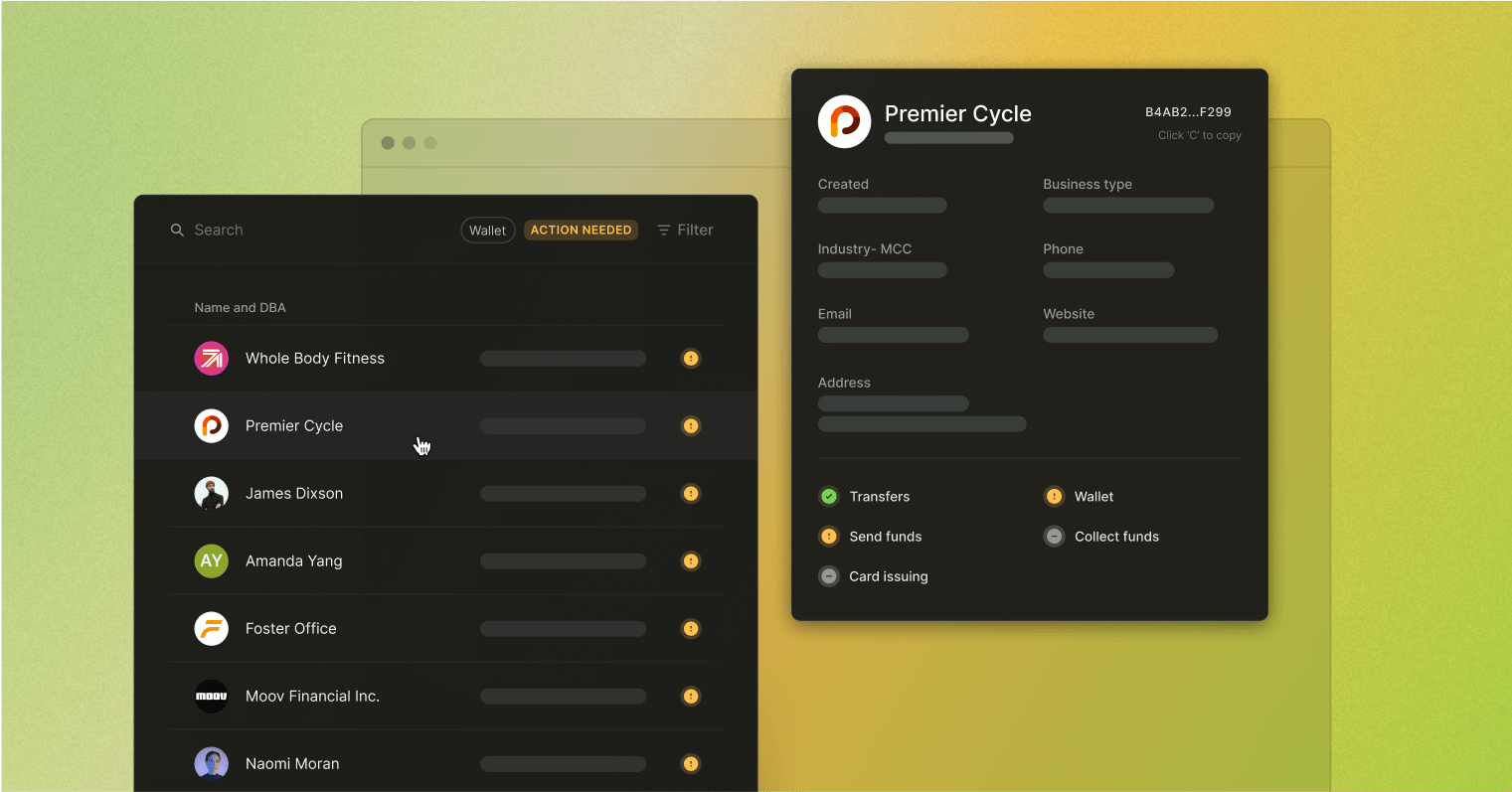

Accounts

The transfers capability no longer requires a website or description for businesses.

Bug fixes

- Improved error handling for the add funds flow.

- Fixed a bug in which disabled payment options were being returned as transfer options.

- Fixed a bug where the status reason for RTP credit failure was not appearing.

- Fixed a bug where transfer details stopped loading when viewing multiple transfers back to back.

- Fixed a bug where RTP transactions were showing

0000as thetransactionIDinstead ofMOOV. - Fixed a bug where the account selector in the Dashboard eventually stops working.

- Fixed a bug where ACH credit failures were not producing the correct failure response.

- Fixed a bug where accounts were receiving a message that a website or description was missing even though the requirement has been removed.

- Fixed misspelling of “website” in an error message in the onboarding Drop.

- Fixed an issue that prevented Moov Drop dialogs from scrolling vertically on small screens.

- Fixed an issue where the representative avatar was loading the main Moov account avatar instead in the onboarding Drop.