Deprecation notice & Dashboard sweeps update

Endpoint deprecation notice

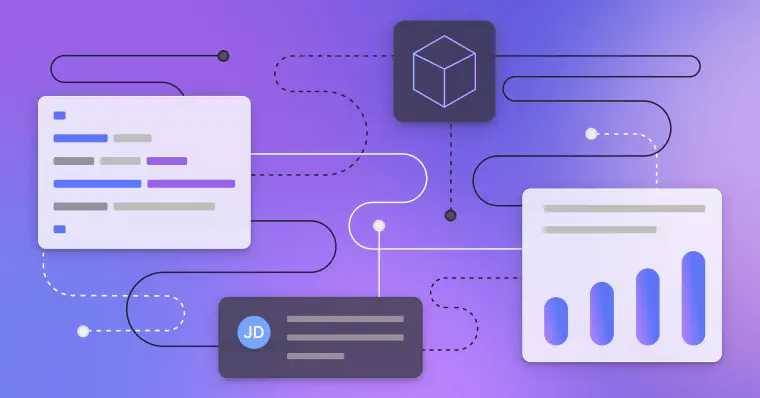

We've recently created two new endpoints to replace existing ones. The following endpoints will be removed from our public documentation and will be fully deprecated in the future:

Please switch to the following new endpoints:

Sweep transaction details

Coming soon in the Dashboard, the sweep transaction summary will show a chart of all wallet transaction types. You can select Amount or Count to see specific details.

Bug fixes

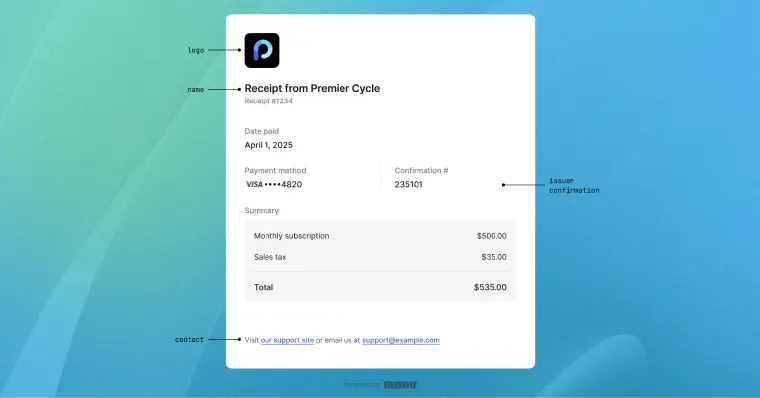

- Fixed a bug where incorrect customer support information was being shown to cardholders

- Fixed a bug where providing the monthly volume requirement moved the status to pending review instead of fulfilled