Updates to test mode, API, Go SDK, Dashboard & more

Account name inquiry in test mode

Test mode now supports name verification with Visa's ANI verification. You can test various results by entering in different name combinations.

View our test mode guide for more information.

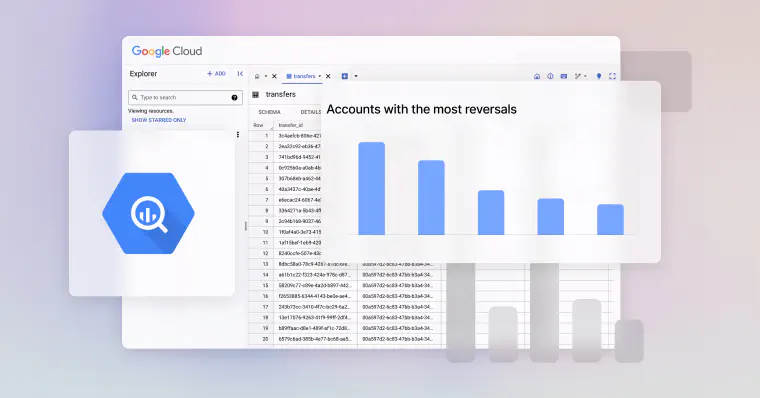

New transfer history endpoints

Two new endpoints have been added to the accounts API:

/accounts/{accountID}/transfers/{transferID}/accounts/{accountID}/transfers

These endpoints allow you to retrieve an account transfer or list account transfers using query parameters. Moving forward, we suggest using the new list account transfers endpoint over the existing list transfers endpoint.

Go SDK updates

Webhook support for sweeps has been added to the Go SDK.

Additionally, the verifyName field has been added on POST /cards and the verifyName and holderName fields have been added on PATCH /cards/{cardID} to support ANI verification.

API updates

We've relaxed the validation for the website field within a business profile to allow paths.

Dashboard updates

We added the ability to search by sweepID in the wallet view of the Moov Dashboard (previously this was only available via the API).

Bug fix

We fixed a bug where an account's capabilities could show a pending status with no listed requirements.