ACH transfers

What is ACH?

ACH (Automated Clearing House) transfers are electronic funds transfers between two financial institutions that can both push funds (ACH credits) and pull funds (ACH debits).

How ACH works with Moov

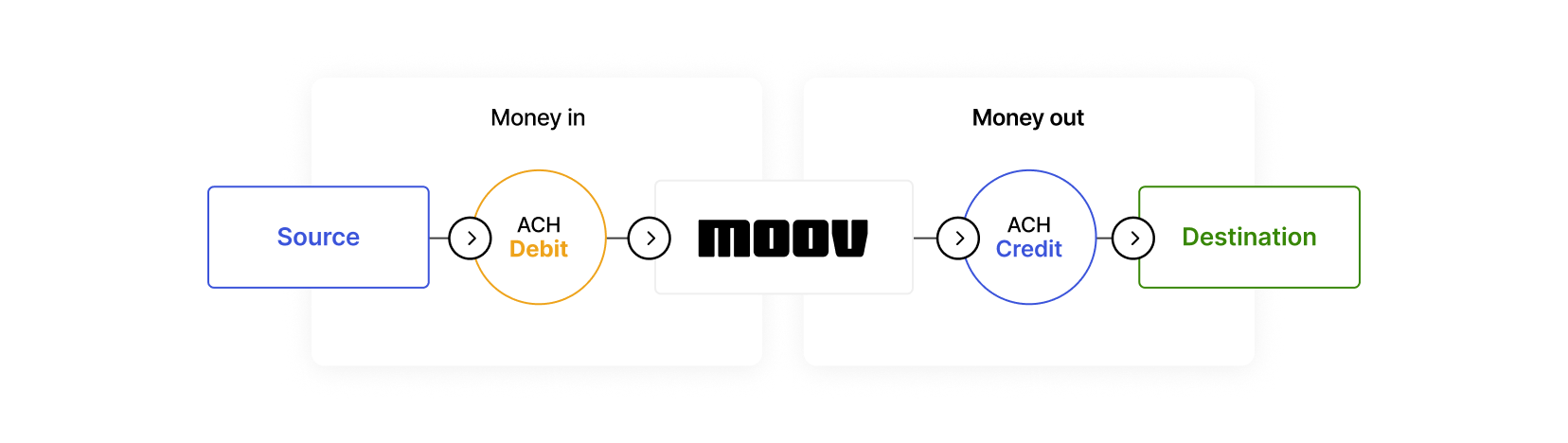

Moov does not move money directly between external bank accounts. All funds move through the Moov platform on the way to their final destination. In practice, money must move into Moov before it can move out.

The flow shown above can be achieved in a single transfer when the source and destination are both external bank accounts linked to a Moov account. ACH can also be used to add or withdraw funds from a Moov wallet. Below is a list of transfer types that use the ACH process:

- Bank-to-bank: Requires both the debit and credit portion of the ACH process

- Bank-to-wallet: Requires the debit portion of the ACH process

- Wallet-to-bank: Requires the credit portion of the ACH process

In order to facilitate any type of ACH transfer with Moov, you will need to ensure the source and destination accounts have the necessary capabilities and payment methods.

Overview

Create payments that directly involve external bank accounts using the Automated Clearing House (ACH) network.

Processing speed

ACH payments are processed in batches and must be uploaded to Moov's partner financial institutions before certain cutoff times. In general, no news is good news - the payment succeeded unless you receive a subsequent return file stating that it did not.

Details & statuses

View possible statuses and details for your ACH transfers.

Returns & exceptions

Different ACH return scenarios and how to troubleshoot various errors.

Cancellations

Cancel an ACH transfer.