Billing

Moov supports flexible fee structures based on your needs and processing flows.

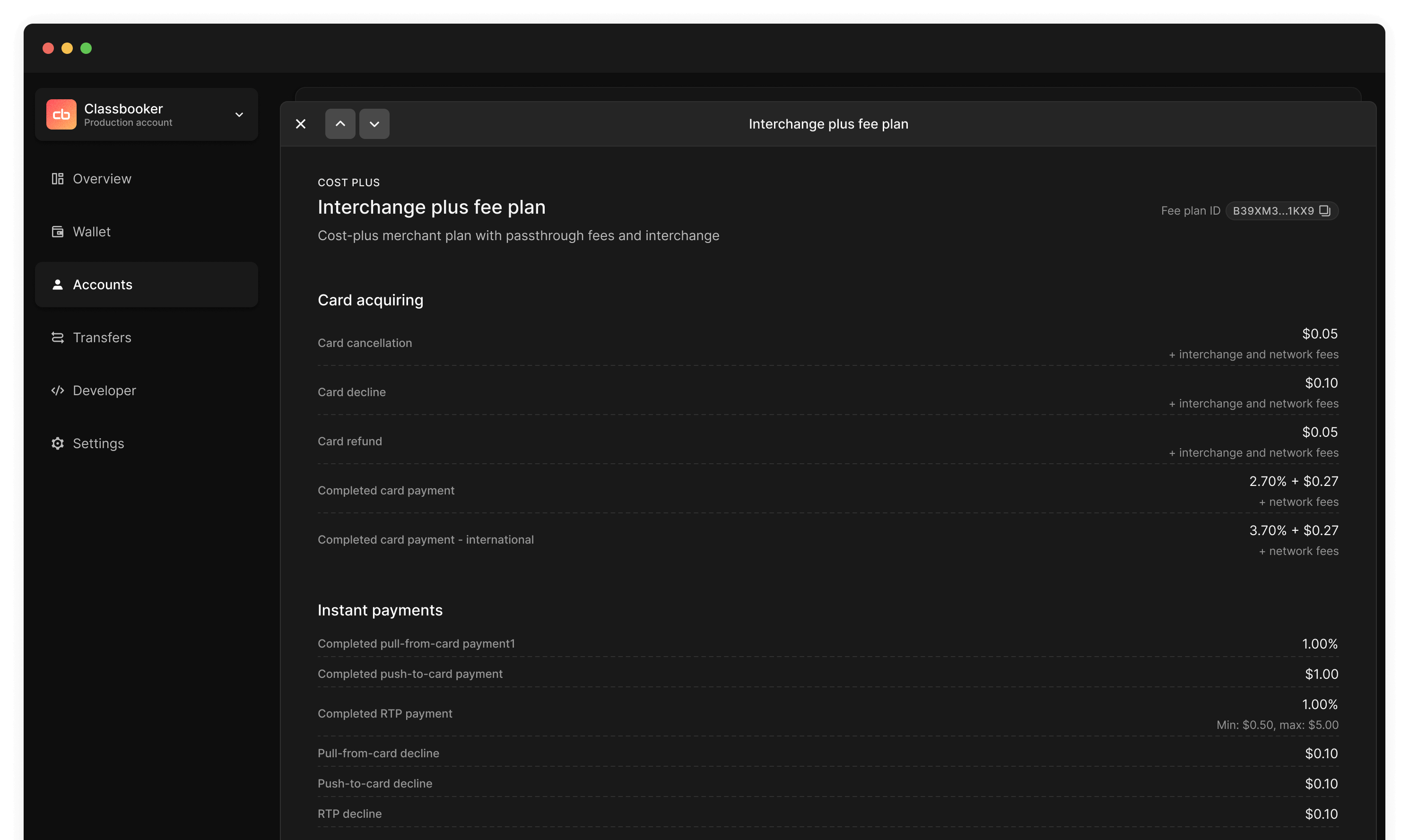

Fee plans help you monetize payment processing costs by passing them on to your merchants.

Key factors:

- Fee plans cover only payment processing costs, they don't include additional administrative fees (like monthly platform fees)

- These plans apply to businesses/merchants for payment processing, not to individual cardholders or accounts

- Each merchant can have their own fee structure based on their payment volume and needs

Use the guides in this section to learn about Moov's fee plan options and how to select and assign plans to your merchant accounts.

Articles in this section

Fee plan options

Set up a fee plan and pricing for a single merchant, or reuse a template for many merchants.

Assign fee plans

Learn how to configure payment processing fees for your platform.

Merchant statements

Learn how to access and understand your monthly merchant statements for reconciling processing costs.

Billing API

View the API reference for this section.