Money movement

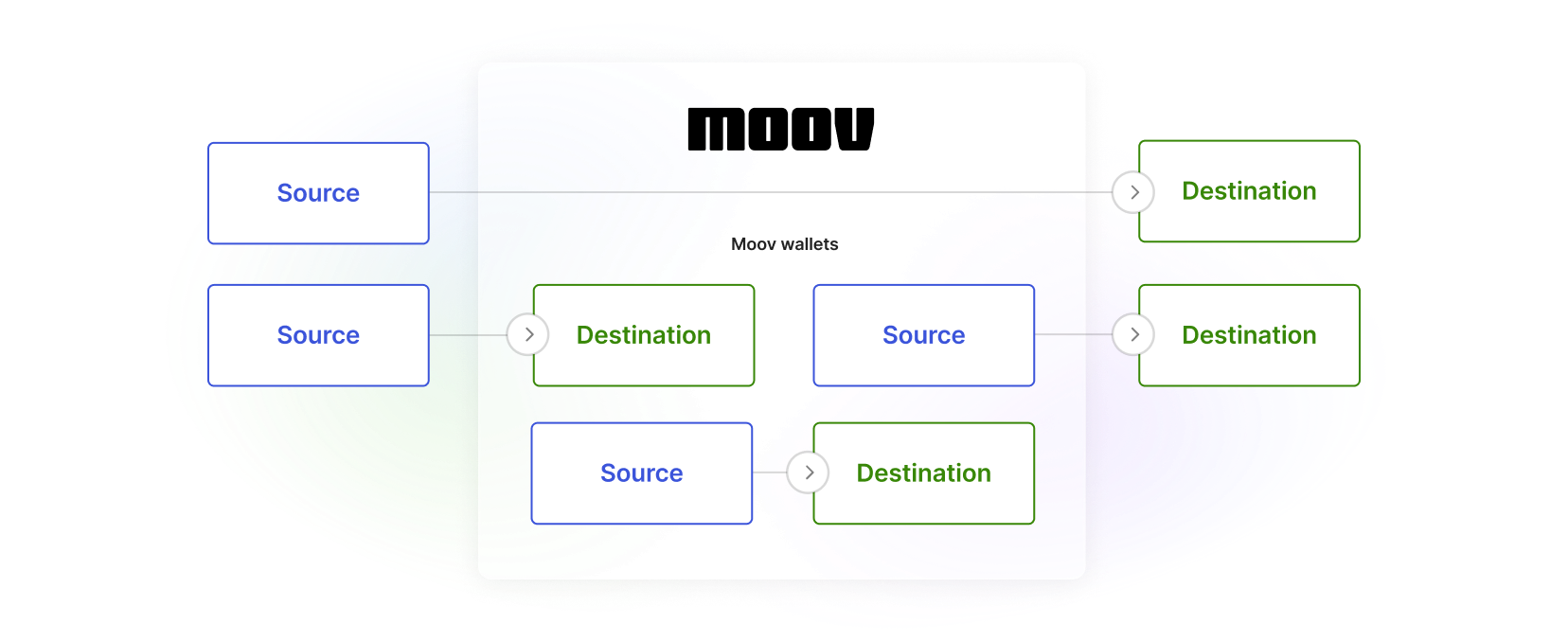

Transfers occur between a source (where funds originate) and a destination (recipient of funds). The diagram below shows how funds flow from a source to destination on Moov's platform.

Moov supports multiple payment rails depending on the account and its capabilities. Use the guides below to learn more about payment method requirements, rail options, and how to respond to various transfer responses and statuses.

Moving money incurs fees - for details on Moov's fee types, billable events, and fee plans, visit our fees section.

Payment methods

Learn about payment methods and every way an account can move funds to another account.

Schedules

Automate money movement on a recurring basis. Define a recurring schedule with a transfer amount, source, and destination.

Transfer groups

Transfer groups eliminate delays and create a seamless payment experience for multiple parties involved in a single transaction payment flow.

Receipts

Send branded receipts to payers for each transfer.

Events & statuses

See different transfer failure scenarios and how Moov handles them.

Wallets

See how to use wallets in various transfer scenarios.

Accept payments

Transfer funds using cards, ACH, push to card, RTP, and Moov wallets as payment options.

Send payments

Follow our how-to guides to facilitate transfers between accounts, transfer funds to yourself, and send payouts.

Transfers API

View the API reference for this section.