Wallets

Moov wallets allow account holders to store funds while providing flexibility on when and how they would like to move those funds. Use this guide to understand how to use wallets in various transfer scenarios.

With wallets, there are a number of possible transfer scenarios:

- Fund a wallet (the wallet as the transfer destination)

- Transfer funds between two different Moov wallets (wallet-to-wallet)

- Cash out funds from a wallet (the wallet as the transfer source)

Transfer types and timing

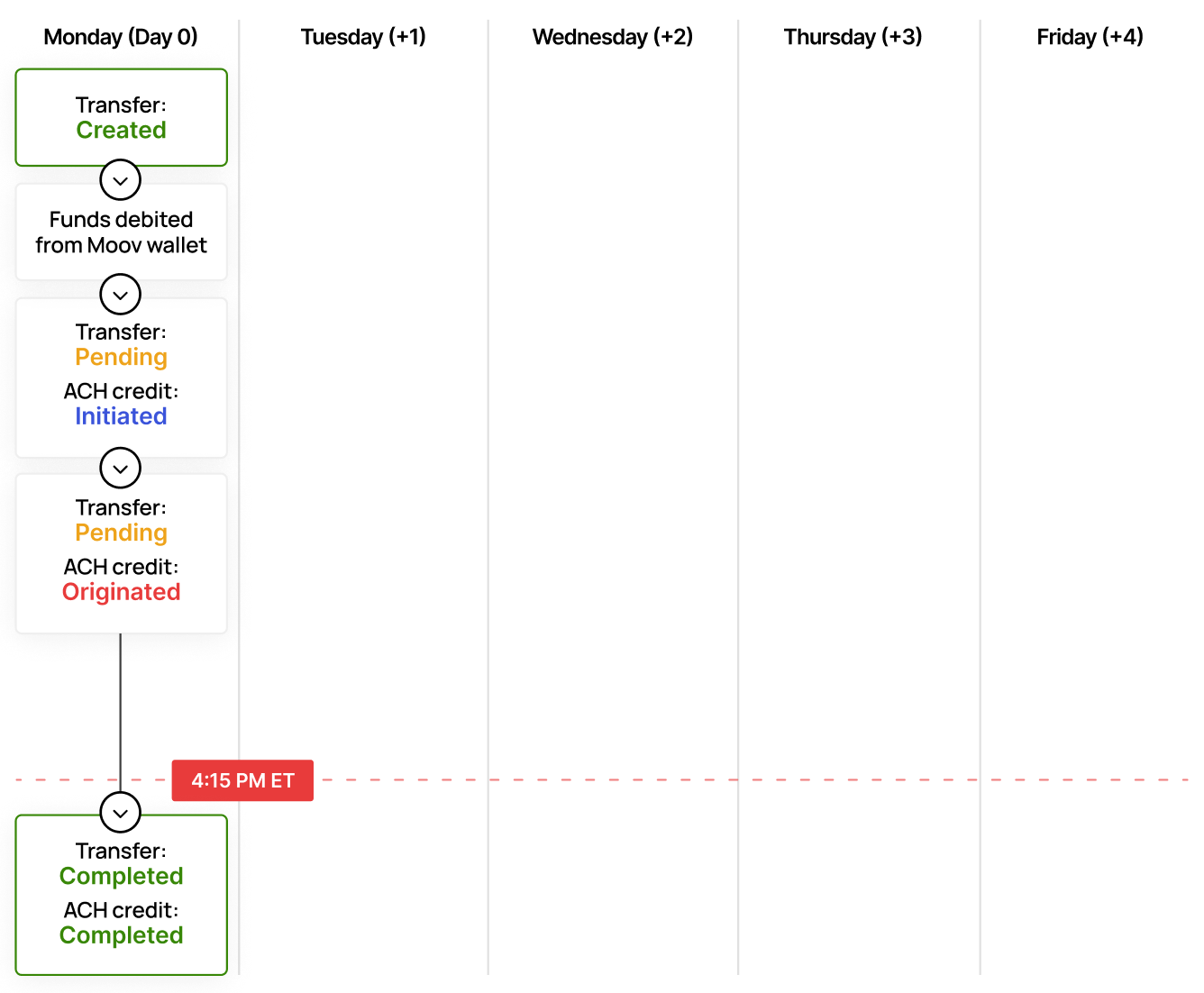

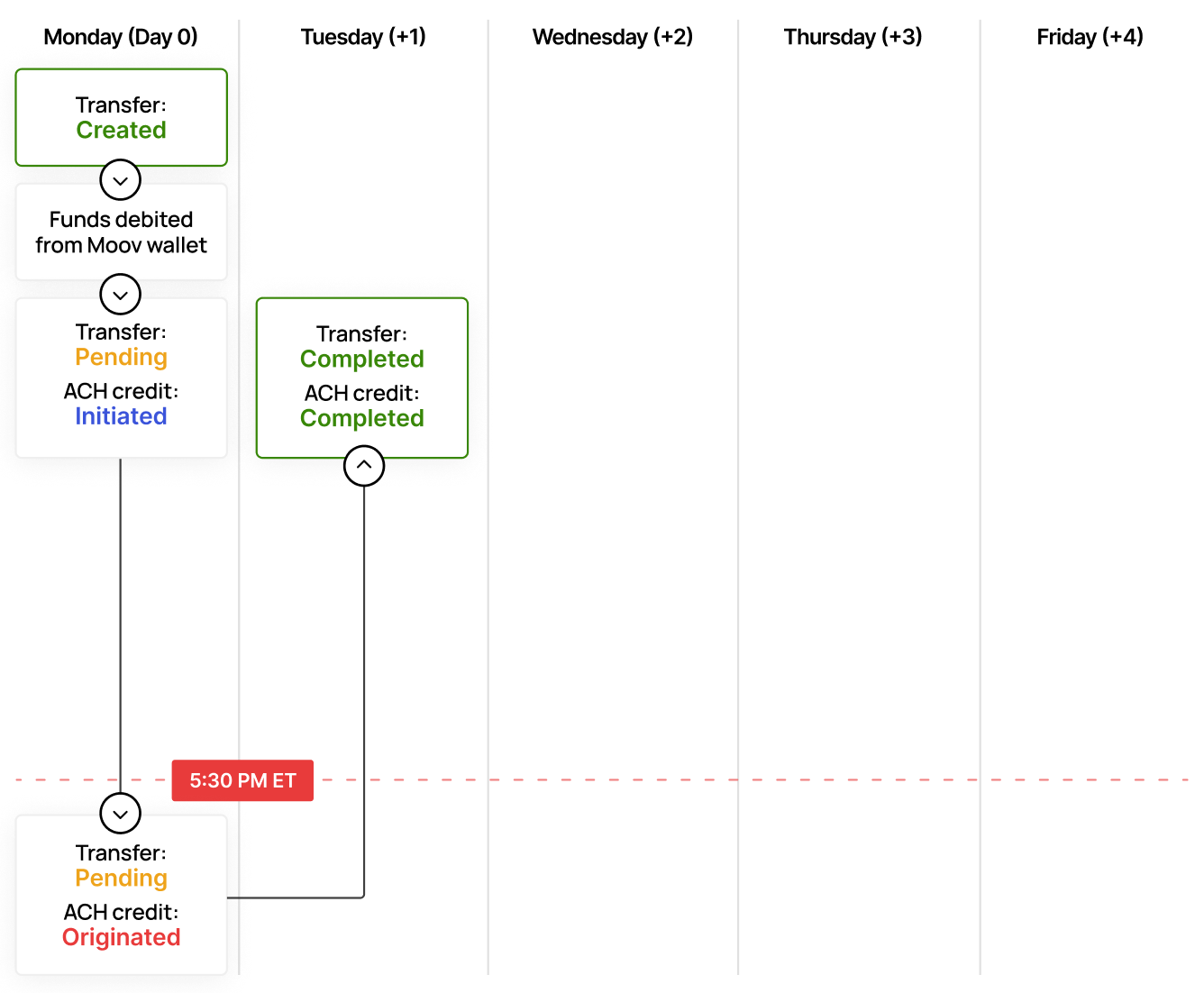

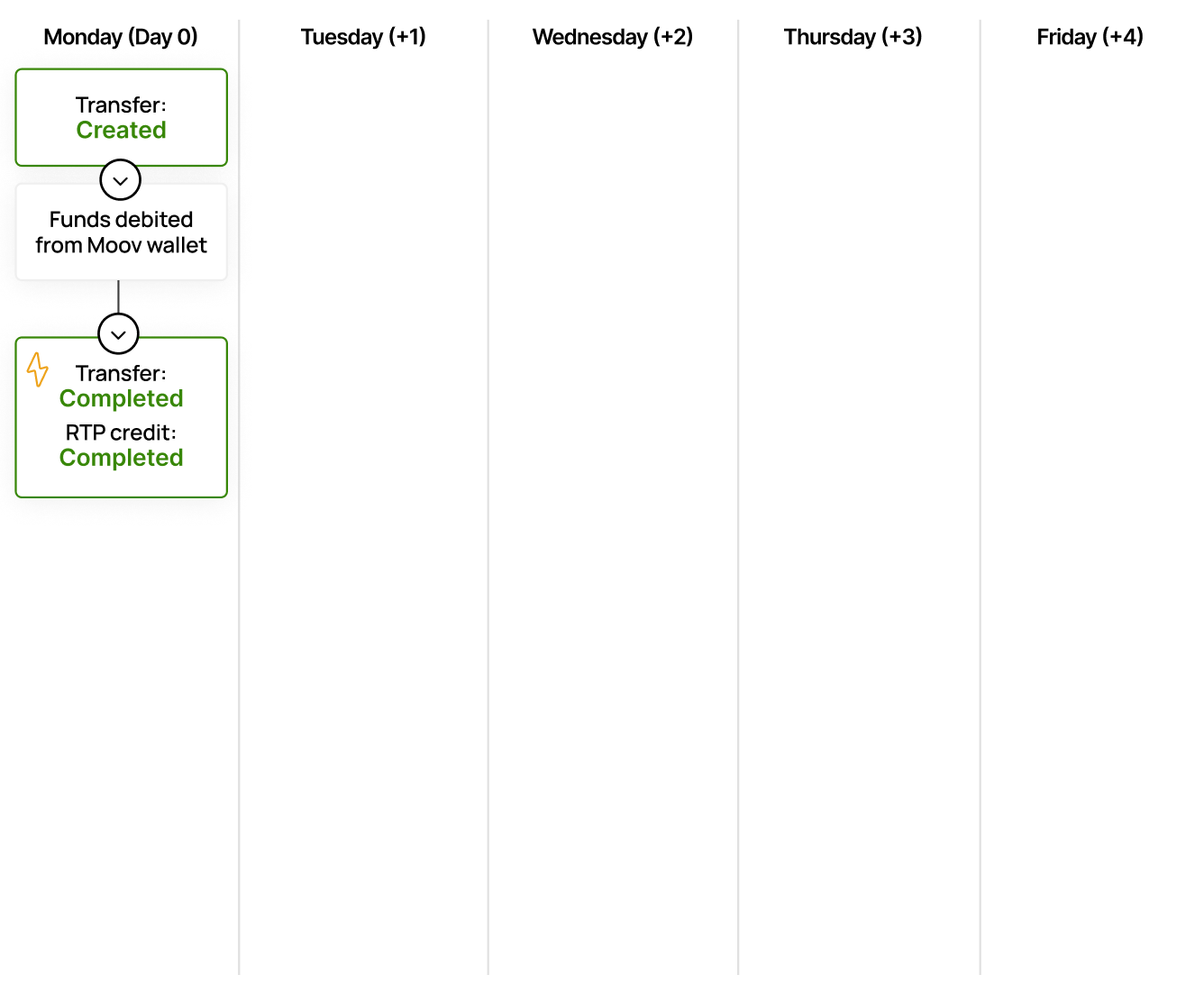

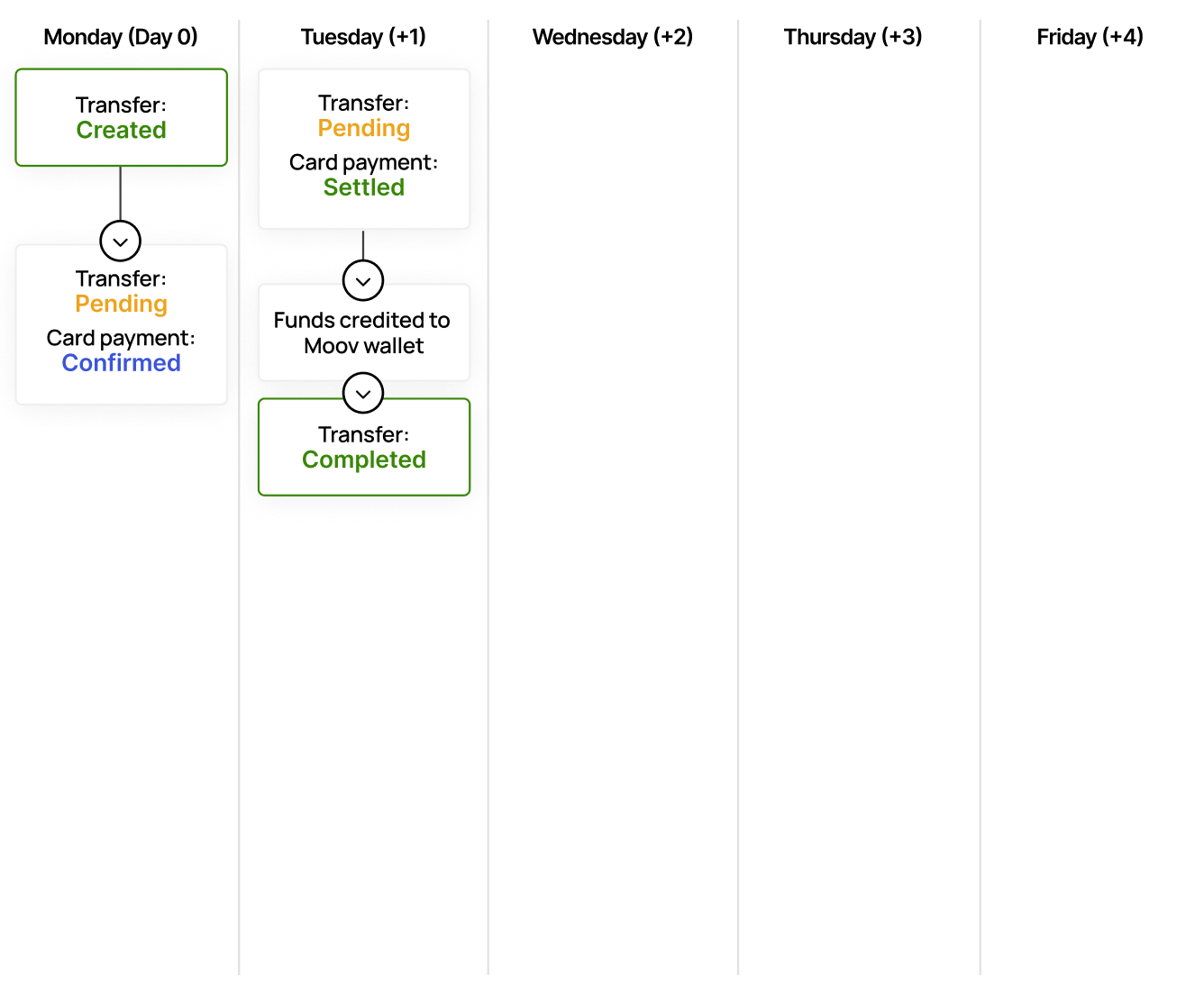

You can use wallets in several ways, depending on your needs and priorities. Below, we summarize different types of wallet transfers and the associated timing.

Funds availability timing

| Transfer type | Payment method | Funds availability |

|---|---|---|

| Bank-to-wallet | ach-debit-*,moov-wallet |

2-3 banking days |

| Wallet-to-wallet | moov-wallet |

Immediately |

| Wallet-to-bank | moov-wallet, ach-credit-* |

End of day for ach-credit-same-day, Next banking day for ach-credit-standard |

| Card-to-wallet | card-payment, moov-wallet |

Next banking day |

In some instances, there might be a delay in your wallet funding. To protect both your business and Moov from potential risks, there may be instances where we temporarily hold funds for further review. This precautionary measure helps safeguard your business from fraud that could result in chargebacks.

Common scenarios that could lead to a review include:

- A new account with limited transaction history

- Unusually high payment volumes compared to typical account activity

- Certain use cases or business types that present increased risk

For more information, contact Moov.

Articles in this section