RTP transfers

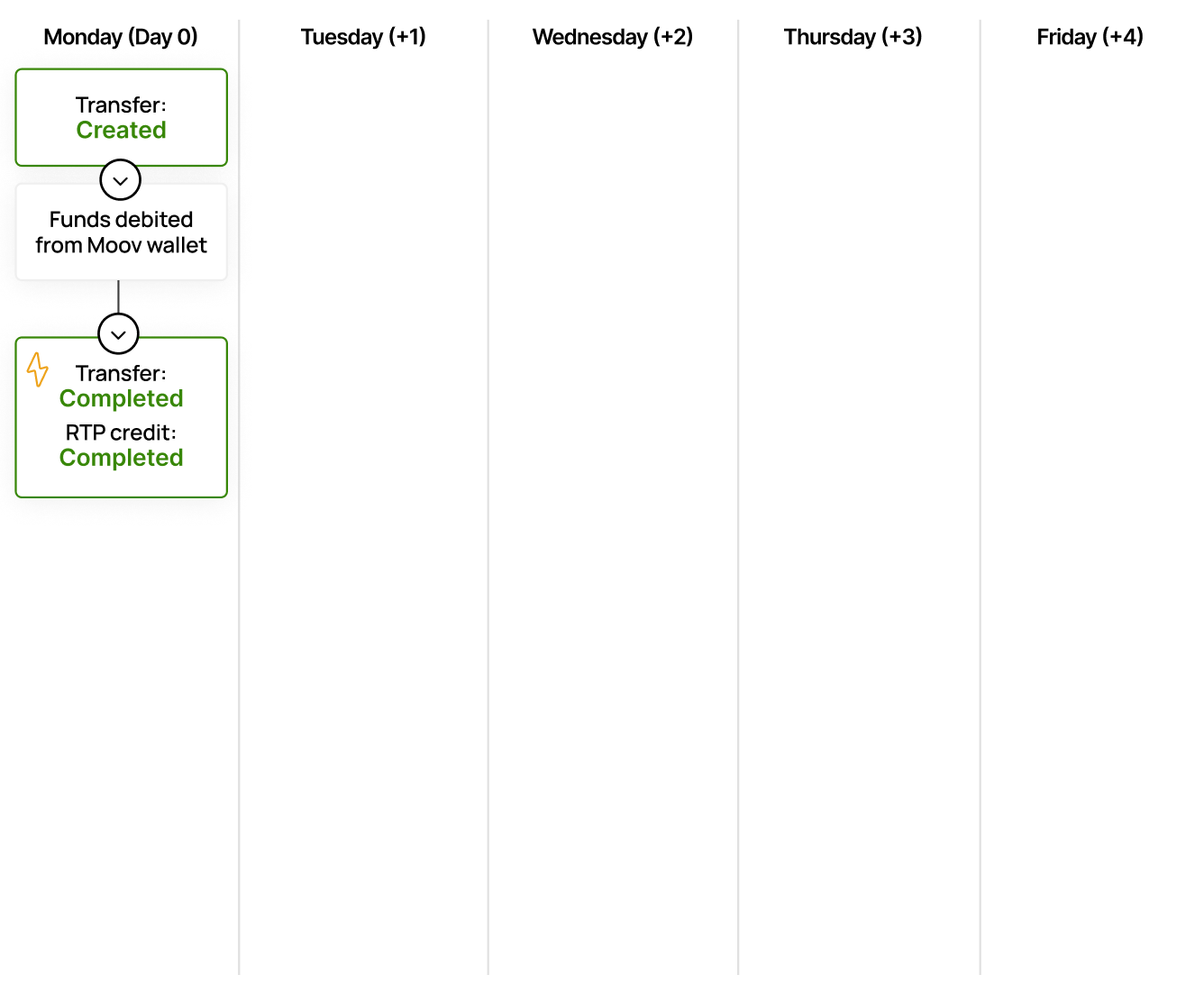

RTP (Real-time payments), enabled by The Clearing House, are instant payments between bank accounts. With RTP, transfers are processed almost immediately, 24/7/365. About 65% of US demand deposit accounts can participate in the RTP network, with more banks adding support regularly.

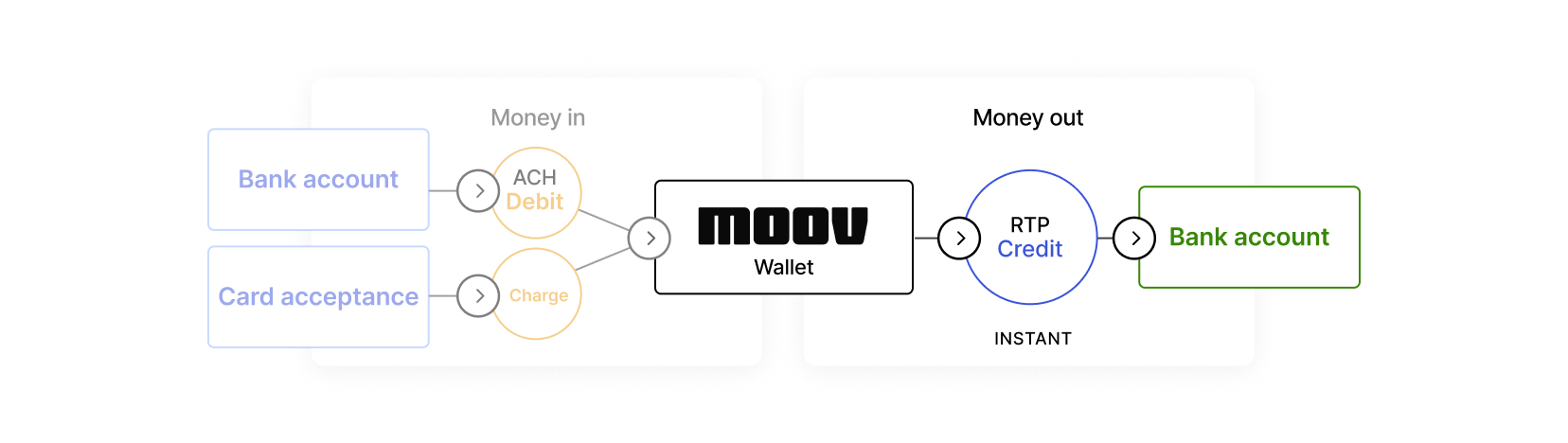

With Moov, supported bank accounts can receive RTP transfers from a Moov wallet instantly.

Bank account eligibility

When a bank account is linked, Moov checks its eligibility to receive payments on the RTP network and creates the instant-bank-credit payment method (or rtp-credit for legacy accounts).

To use RTP, accounts must have the send-funds.instant-bank and wallet.balance capabilities enabled.

Money out

Funds leave the Moov platform with RTP credits when using the instant-bank-credit payment method (or rtp-credit for legacy accounts). Once funds are sent, the transfer is final and cannot be reversed. For RTP credit, Moov has a platform limit of $10,000,000.00 per transaction.

The benefits of sending funds with RTP:

- RTP transfers can be sent instantly, anytime - even on weekends and bank holidays

- Funds are available to the recipient in moments

- Moov wallet balances are immediately decreased

RTP processing and status details

The rtpDetails object offers a variety of useful information about RTP transfers and status details. You can obtain details about a transfer through the transfers GET endpoint. If the destination uses an RTP payment method, the transfers details response will contain an rtpDetails object that contains the following information:

status- Rail-specific status detailsfailureCode- Moov designated failure explanationnetworkReasonCode- The Clearing House raw failure code response

RTP statuses

The rtpDetails contains rail-specific transfer status information:

| Transfer status | Description |

|---|---|

initiated |

The payment has reached the rail, but Moov has not yet received a response |

accepted-without-posting |

Moov has received an accepted without posting message from the receiving bank, as they need more time to process the payment. The funds are moved but are not yet available to the recipient. |

completed |

Moov has received an accepted message from the receiving bank, and funds are available to the recipient |

failed |

Moov has received a rejected message from the receiving bank. The failure code, reason, and description is provided in the transfer response. |

Failure codes

If there is an issue with a bank account, Moov automatically adjusts the status. If you receive an errored bank account status, you will need to take the following action before you can continue processing with Moov:

- Add a new bank account (or contact Moov)

Below you'll find the details on failure codes and the action you'll need to take.

| Failure code | Description | Status: action |

|---|---|---|

account-blocked |

Account is blocked. Transactions cannot be posted against it. | errored: Add new account |

account-closed |

Account is closed. | errored: Add new account |

customer-deceased |

Customer is deceased. | errored: Add new account |

invalid-account |

Account number is invalid or missing. | errored: Add new account |

invalid-amount |

Amount entered is invalid. | No action needed |

invalid-field |

A field entry could not be validated. | No action needed |

limit-exceeded |

Amount entered exceeds approved amount. | No action needed |

processing-error |

Transaction could not be processed due to processing error. | No action needed |

transaction-not-supported |

Transaction is not supported. | No action needed |

Refer to the The Clearing House's Message Status Report appendix for the latest ISO RTP error codes (networkReasonCode).