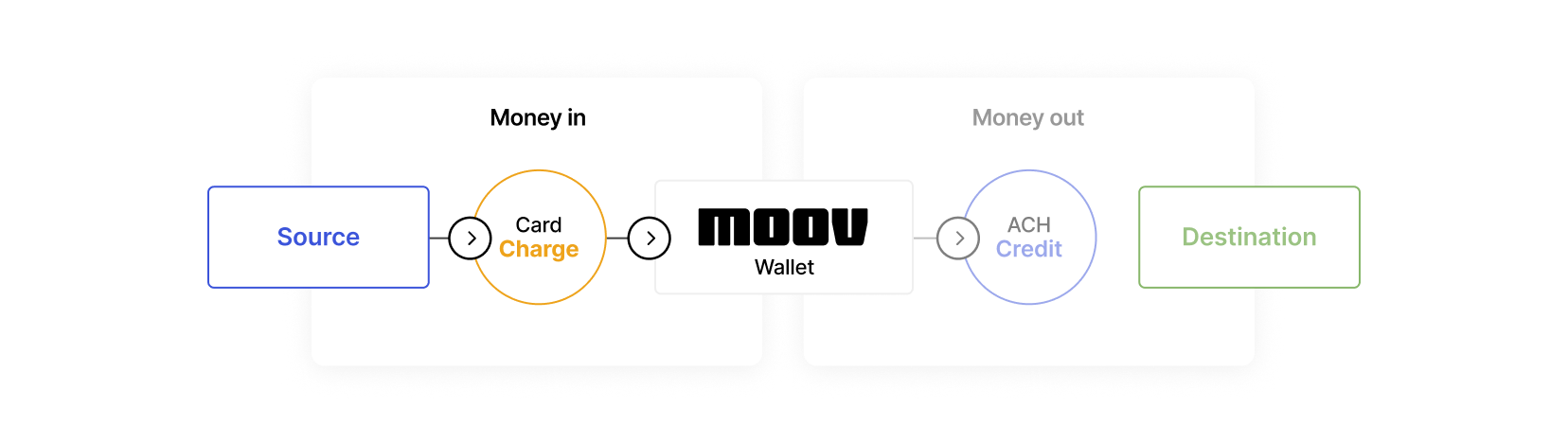

Card acceptance

Once your platform's Moov account is configured for card payments, you can use your customers' card information and the tokenized details to initiate card payment transfers.

Moov has multiple resources to help you get started with card payments. You can simulate card transfers in test mode using pre-populated business data and cards, as well as register a users card with the pre-built card link Drop. If you need to link cards to your customers' accounts, see all available options in our step by step accept card payments guide.

Card status

The status of a transfer can be found in cardDetails.status, which is part of the create a transfer response body. You can also use the list transfers and retrieve a transfer endpoints to get the status.

| Rail-specific status | Description |

|---|---|

initiated |

Transfer has been created |

confirmed |

Successful authorization by the card network |

settled |

Transaction settled with issuer; Moov wallet will be credited by 1 PM ET on a banking day, or the next banking day if it is a weekend or a holiday |

completed |

Funds have been credited to the merchant Moov wallet |

canceled |

Transaction was successfully cancelled and authorization has been reversed |

failed |

Transaction failed; specific failure reason will be in cardDetails.failureCode |

Send card information directly from your user to Moov without handling the PCI data yourself.

You can simulate card transfers in test mode by using specific card numbers.

Send card information directly from your user to Moov without handling the PCI data yourself.

Use the guides in this section to learn about card acceptance on Moov's platform.

Declines

Understand why certain card payments are declined and how Moov categorizes different types of declines.

Disputes

Understand how Moov handles disputes, and the type of information you can receive about them.

Reversals

Learn how to reverse or refund transfers using a more flexible reversals endpoint.

Refunds

Our traditional refund method. See the reversal method for a more flexible option.

Settlement timing

Understand how Moov takes advantage of the last settlement cutoff available for each card network.

Debt repayment

Compliantly process debt repayment transactions and take advantage of interchange incentive programs with lower fees.

Recurring payments

Learn about card schemes and how to implement recurring payments.

Statement descriptors

Customize statement descriptors on card payments to reduce disputes and improve the user experience by providing context.

Transfers API

View the API reference for this section.