Push to card

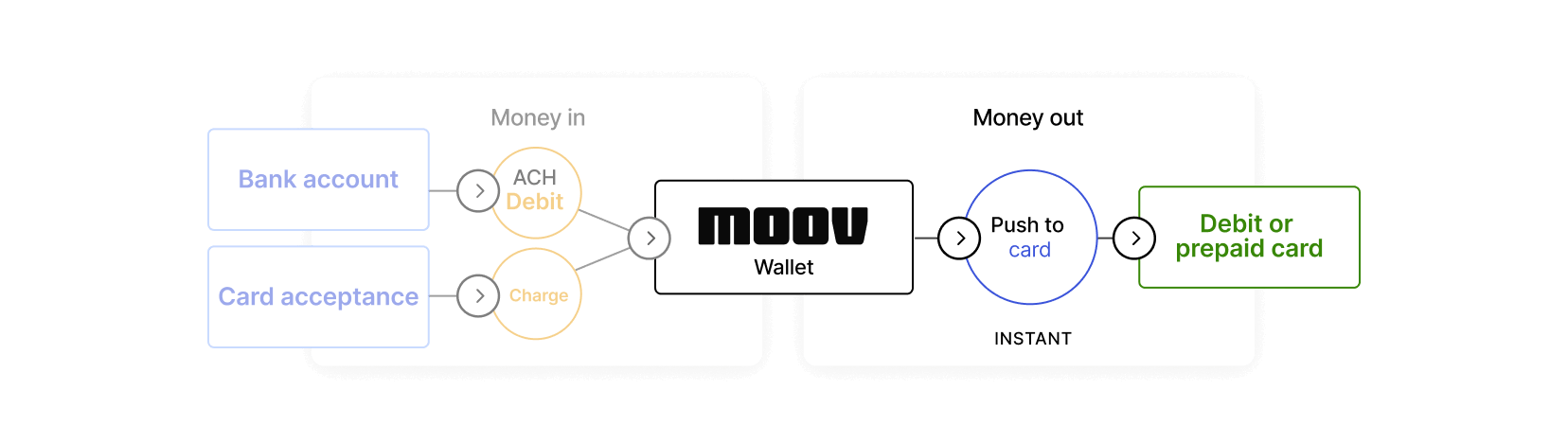

Moov supports push to card payments - instant payments from a Moov wallet to supported Visa and Mastercard debit and prepaid cards. With push to card, you can access funds near real time, 24/7/365.

Use cases

Moov supports push transfers for two use cases: merchant settlement and funds disbursement. Moov will configure the source account depending on your use case:

Merchant settlement is commonly used by businesses that are looking to access their funds faster through a self-to-self transfer from their wallet to a card. If you're using push to card for merchant settlement, the source account must have the wallet capability enabled.

Funds disbursement enables real-time transfers to another account. Some funds disbursement examples include gig economy payouts, insurance disbursements, corporate rebates, payroll, government, or reimbursements. If you're using push to card for funds disbursement, the source account must have the send-funds.push-to-card capability enabled.

Determine support for push to card

Ensure you have linked a card on the account. The simplest way to securely link a card is by using the card link Drop, a prebuilt UI component for embedding card-based payments. If you have provided an attestation of PCI compliance, you also have the option to link a card using the POST link a card endpoint.

Once you've linked a card, you can determine if that card is eligible to receive pushed funds with the domesticPushtoCard field. You can use the cards GET endpoint as shown below.

|

|

|

|

The domesticPushtoCard field describes the push to card timing that is available for the card, if supported:

| Timing | Description |

|---|---|

fast-funds |

Funds will be available to the destination within 30 minutes or less of the authorization. |

standard |

Fast funds is not supported on this card. Transfer will follow standard card settlement timing. |

not-supported |

This card is ineligible for push-to-card payments. Contact your issuer for more details. |

unknown |

Eligibility has not been checked or is unknown. |

Implement push to card

The push-to-card payment method becomes available when the following criteria are met:

- The account has the

transferscapability - The linked card supports

fast-fundsorstandardtiming - Moov has approved the account for push to card transfers

Moov has a transfer limit of $50,000 per push to card transaction. Moov may impose lower transfer limits based on the approved use case.

Initiate the transfer

A push transfer can be created when the source is a pre-funded Moov wallet and the destination is a recipient with a linked card and the transfers capability.

|

|

|

|

Track transfer status

To track the transfer status, view cardDetails under the destination object from the transfers GET endpoint:

initiated- Transaction is created and awaiting authorizationfailed- Issuer declined or there was error with processingcompleted- Authorization request was successful and Issuer approved the transaction

If the card is fast-funds eligible, the destination’s card will be credited the amount specified within 30 minutes. Otherwise, the funds will be credited according to the standard network settlement timing.

|

|

|

|

Transfer & velocity limits

There are limits on the amount a card fingerprint can send within a specified time. Depending on the card brand, you will need to follow these limits specifying the maximum amount and count that the destination account can receive. The following limits are for Visa and Mastercard.

| Limit type | Maximum limit |

|---|---|

| Amount | $50,000 |

| 1-day velocity | 150 transactions or $100,000 |

| 7-day velocity | 250 transactions or $250,000 |

| 30-day velocity | 750 transactions or 500,000 |

Error responses

Amount limit: If you have exceeded the amount limit, you'll receive a 400 error response. You can retry the transfer with a lower amount.

Velocity limits: If you have exceeded the velocity limits, push to card transfers will fail. The transfer status will be failed and the failure reason will be rejected-high-risk.

Issuer limits: If you have exceeded issuer limits, the transfer status will be failed and the failure reason will be destination-payment-error. Contact the issuer if you require guidance on specific issuer limits.

The specific transaction decline code can be found in cardDetails.failureCode using the retrieve a transfer endpoint or the list transfers endpoint.

You'll also receive a 400 error response if your account is not enabled for disbursement. If you need to enable disbursement, please contact Moov so we can configure your account accordingly.